Key Takeaways

- Businesses are unwittingly exposing themselves to potential multimillion-dollar fines. Stricter regulation and intense media scrutiny arising from further leaks like the Pandora papers are a wake-up call to take a more holistic approach to holistic risk management, and specifically AML risk.

- Learn how companies can remain compliant and avoid going into business with bad entities and actors while reducing spiralling compliance costs and complexity.

Like famous fraudsters, money laundering has its poster children. Take the revelations of the Pandora Papers, which featured an eclectic mix of politicians, rockstars, dictators, and well-known businesses. While these more notable names may make the headlines, we shouldn’t forget that the big value loss is in the long tail of daily activities taking place across a range of financial services like banking, online payments and marketplaces, tax services, and remittances.

Don’t get your hands dirty

Too many businesses expose themselves to Money Laundering (ML) risks while investing vast sums in compliance (headcount, operations, and vendor costs). The new 6th Anti-Money Laundering Directive (6AMLD) will heap further pressure on financial services by extending criminal liability to legal persons and introduce a tougher punishment regime overall. This makes it easier for law enforcement to pursue those often described as enablers who facilitate money laundering or who serve as accomplices in money laundering schemes. The stakes could hardly be higher. Since 2008, regulators have levied over €27 billion in fines to companies caught outside of AML compliance. This is why businesses need a joined-up approach to managing risk and specifically online payments.

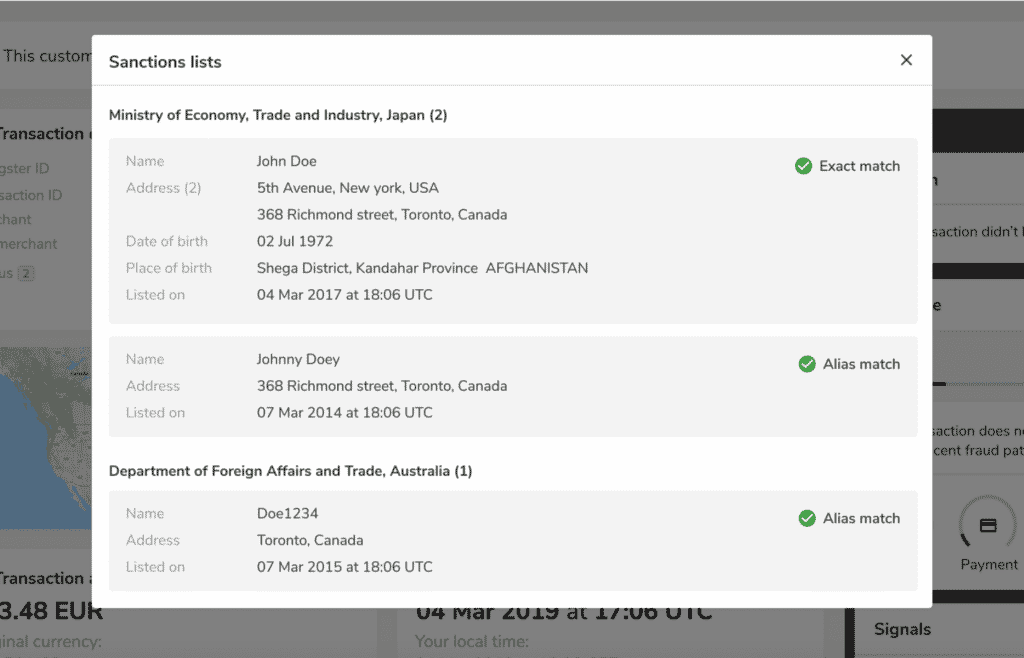

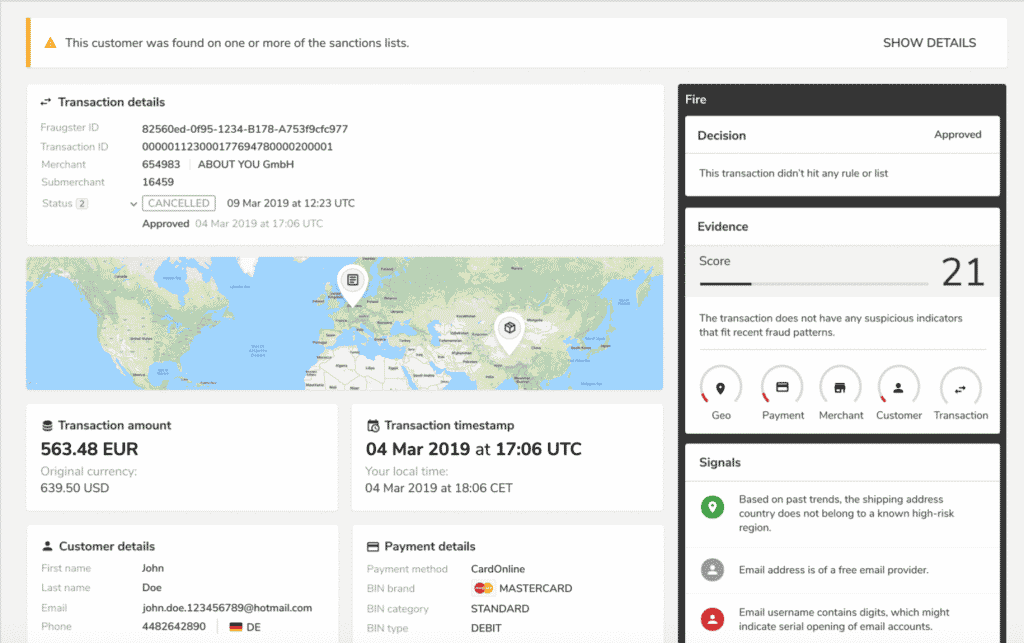

By integrating global sanctions lists, and Politically Exposed Persons (PEP) lists into your core fraud prevention strategy, you can ensure that your company will be both protected and compliant. The ideal scenario would be that your selected fraud solution can work seamlessly with these updated lists, synced and visible in one place.

But how exactly do these global sanctions lists work? And how do they help banks and payment companies save billions on laundering compliance and fines each year?

Anti-Money Laundering Risk Management – Global Sanctions & PEP Lists

Money Laundering Risk Best Practices:

- Know Your Customer (KYC) checks at the Onboarding Stage – For any institution that handles transactions, the point of AML defense should primarily take place at the customer onboarding stage. By identifying sanctioned individuals at the signup stage via up-to-date sanctions and PEP lists, you can protect your business from transacting with them altogether. This is vital to ensuring that you are not facilitating sanctioned persons and entities by giving them unchecked access to your services.

- Know Your Business (KYB) verifications for sellers – It isn’t just customers that need to be verified and cross-checked in global sanctions lists. Businesses need to be properly vetted as well. Especially when it comes to marketplaces, where a bad actor could set up a business to make repeat purchases from other accounts to “clean” their money. Similar to the customer onboarding stage, KYB success is best handled at the earliest stage of the relationship: When the seller is looking to register. If the marketplace can weed out the bad sellers early, then the ML risk significantly reduces.

More Robust Anti-Money Laundering Controls

It is not enough to simply have access to global sanctions and PEP lists in isolation. You need to be able to analyze the user data coming into your system to correctly isolate the bad entities in real-time. And the best way to achieve this is through a process known as data enrichment.

When a transaction is attempted, there are base-level data points provided. Using a mix of AI and behavioral intelligence, these data points are analyzed and expanded upon to create thousands of additional information markers to give a clearer understanding of the intent behind the purchase. The result of this transactional analysis is a highly accurate determination on the legitimacy of a purchase attempt that also complies with the most updated sanctions lists available.

By combining this investigation process with access to official Sanctions and PEP lists, companies can remain secure and compliant while keeping the customer’s purchasing journey as frictionless as possible.

This post has been contributed by Christopher Brennan, Senior Content Manager at Fraugster